A balance between optimization and uncharted waters

Organizations’ digital transformation initiatives are primarily driven by productivity and operations—achieving current goals faster and better. However, innovation-driven efforts could prove equally valuable.

AS organizations seek to invest in digital transformation initiatives, they can find themselves at something of a crossroads. Focused first on pursuing greater efficiencies in their current processes, most organizations are largely using Industry 4.0 technologies to improve what they’re already doing. This is to say, organizations’ digital transformation initiatives are primarily driven by productivity and operations goals: fulfilling current goals, but faster, and better.

This makes sense: Before blazing trails through uncharted terrain to seek Industry 4.0-driven innovation, organizations may first want to build a firm foundation and find and train the right talent to propel them forward. However, opportunities also exist in innovation. Our survey found that high ROI is almost as likely to result from investments in innovation as from investments in productivity—suggesting many organizations may be leaving innovation-driven digital transformation opportunities untapped, even as they benefit from productivity- and operations-driven initiatives. Further, the self-reported maturity levels of respondents—coupled with the specific investments they are making, or considering making, in new, Industry 4.0-driven capabilities—suggest that executives are preparing for a more digitally advanced future. Making innovation a part of that future may be an important component of success. Not doing so may mean being left behind.

Executives are preparing for a more digitally advanced future. Making innovation a part of that future may be an important component of success. Not doing so may mean being left behind.

Drivers for digital transformation investment

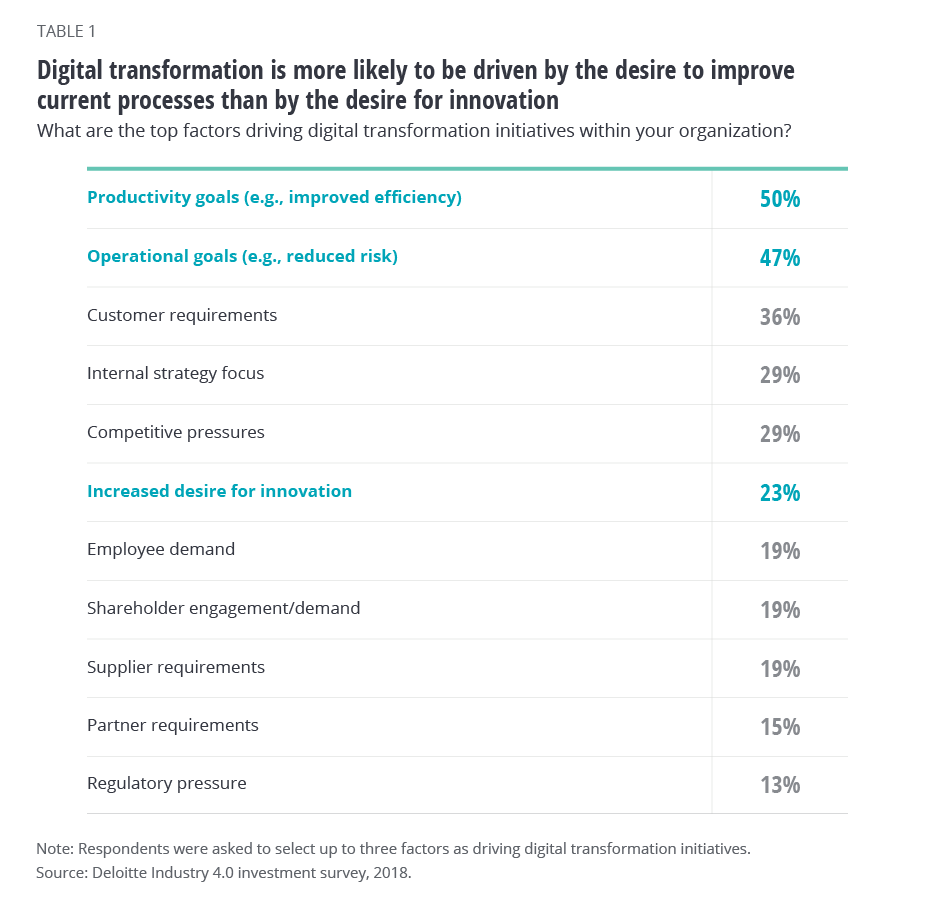

When it comes to digital transformation, most respondents report that their companies are driven largely by improving their current processes, rather than innovating (table 1). In fact, roughly twice as many respondents reported being driven by productivity and operations goals rather than by the desire for innovation, by competitive pressure, or even by customer requirements. Further, this trend shows no signs of slowing: Those who plan to significantly increase digital transformation investments in the next year are driven more by operational goals, at 52 percent, than those who plan to only moderately increase investments (45 percent) or keep them the same (36 percent).

This approach—starting with streamlining current efforts before moving on to innovation—is one that appears to hold true across industries and does not appear to be limited solely to those specific industries surveyed for this study. In fact, Deloitte’s global, cross-industry study The Fourth Industrial Revolution is here—are you ready? showed that many executives continue to focus on traditional business operations with respect to Industry 4.0 transformation, rather than focusing on new opportunities to create value.1

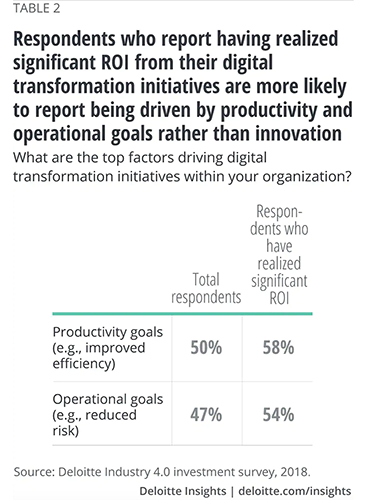

Even those whose organizations have realized significant ROI from digital transformation report being driven by productivity and operational goals—even more so than general respondents, suggesting that perhaps focusing on those initial areas for digital transformation can yield significant returns that encourage further investment (table 2).

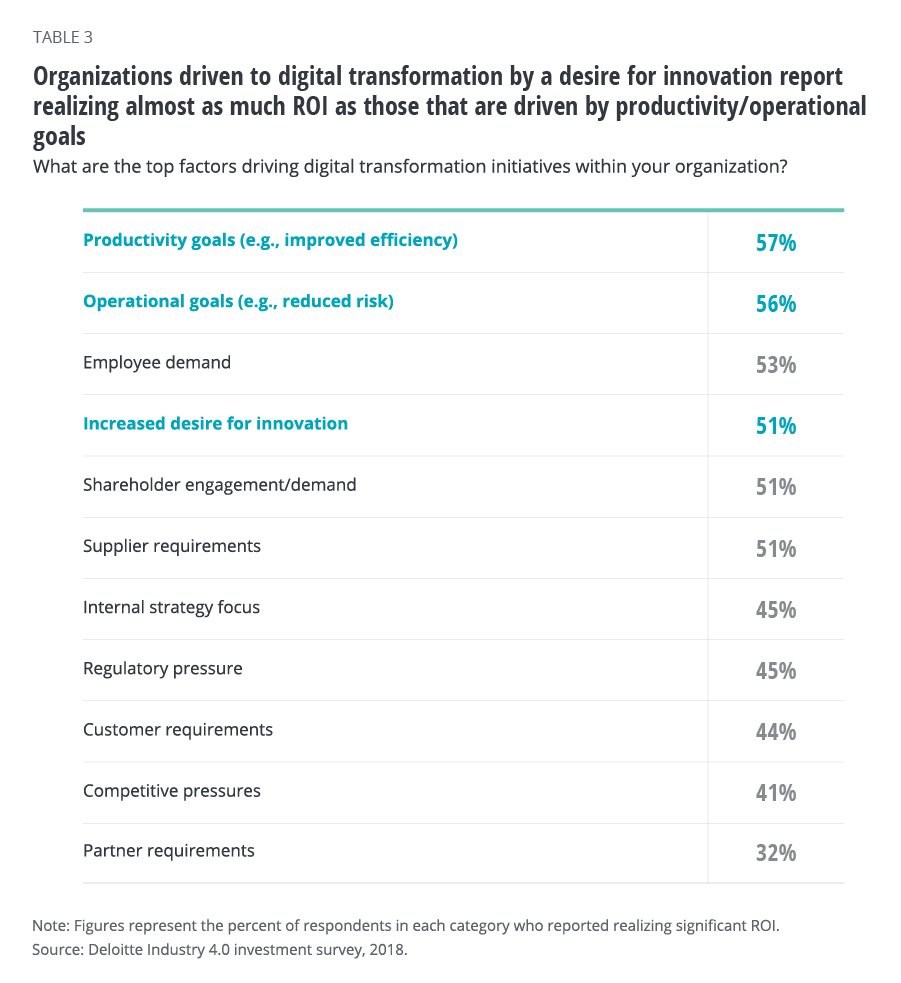

However, changing the lens appears to reveal a new insight: Those driven by innovation are nearly as likely to report recognizing significant ROI from digital transformations as those who are driven by operations and production goals (table 3). Fifty-seven percent of those driven by productivity goals and 56 percent of those driven by operational goals report realizing significant ROI; 51 percent of those driven by innovation say the same.

Leaders driven by innovation are nearly as likely to report recognizing significant ROI from digital transformations as those who are driven by operations and production goals.

This suggests that the innovation opportunities that exist may be as likely to result in significant ROI as operations- and productivity-driven initiatives. To be sure, starting the shift to Industry 4.0 with improving current processes is a sound approach, and can create a firm foundation for future innovations. Moreover, doing so can illuminate key opportunities for innovation, by creating a clear map of what the organization currently does, highlighting adjacencies, and thus creating an informed, more targeted path for innovation.

We can see the success of this sort of progression already, as some manufacturers choose to begin a smart factory transformation by first understanding and analyzing the data their assets are already generating, to ascertain what data they will need and, by extension, where white spaces are for new investments and opportunities.2 However, innovation should be a priority, as it can help organizations differentiate themselves in ways that are often difficult for competitors to respond.3

Maturity and future innovation

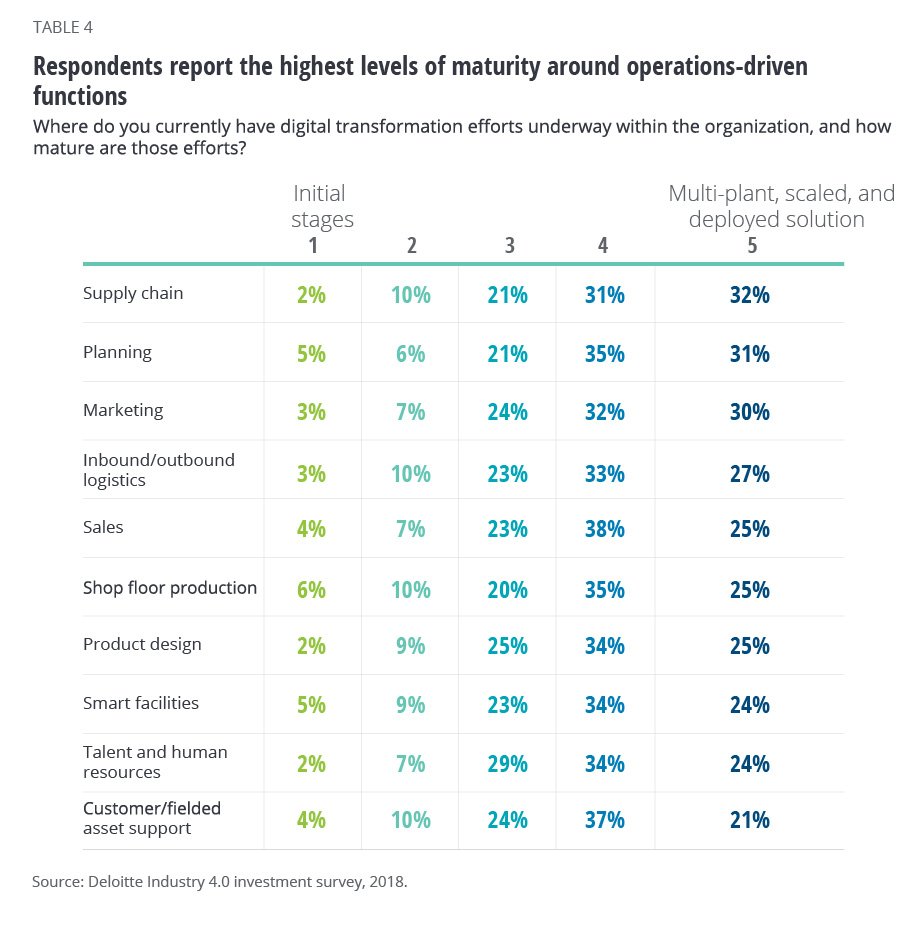

Organizations are in different stages of building and scaling digital capabilities across their businesses. Respondents report the highest levels of maturity around operations-driven functions: supply chain (32 percent), planning (31 percent), and marketing (30 percent) report the highest levels of multiplant, scaled solutions (table 4).

Functions that tend to drive productivity or innovation, however, are relatively less mature: shop floor production, product design, smart facilities, and customer/fielded asset support. These are areas that typically tend to leverage advanced technologies and capabilities on a broad scale. Further, they require that data be generated from many diverse physical assets and systems that may not have been connected in the past.4

Current use of technologies—and future investment plans

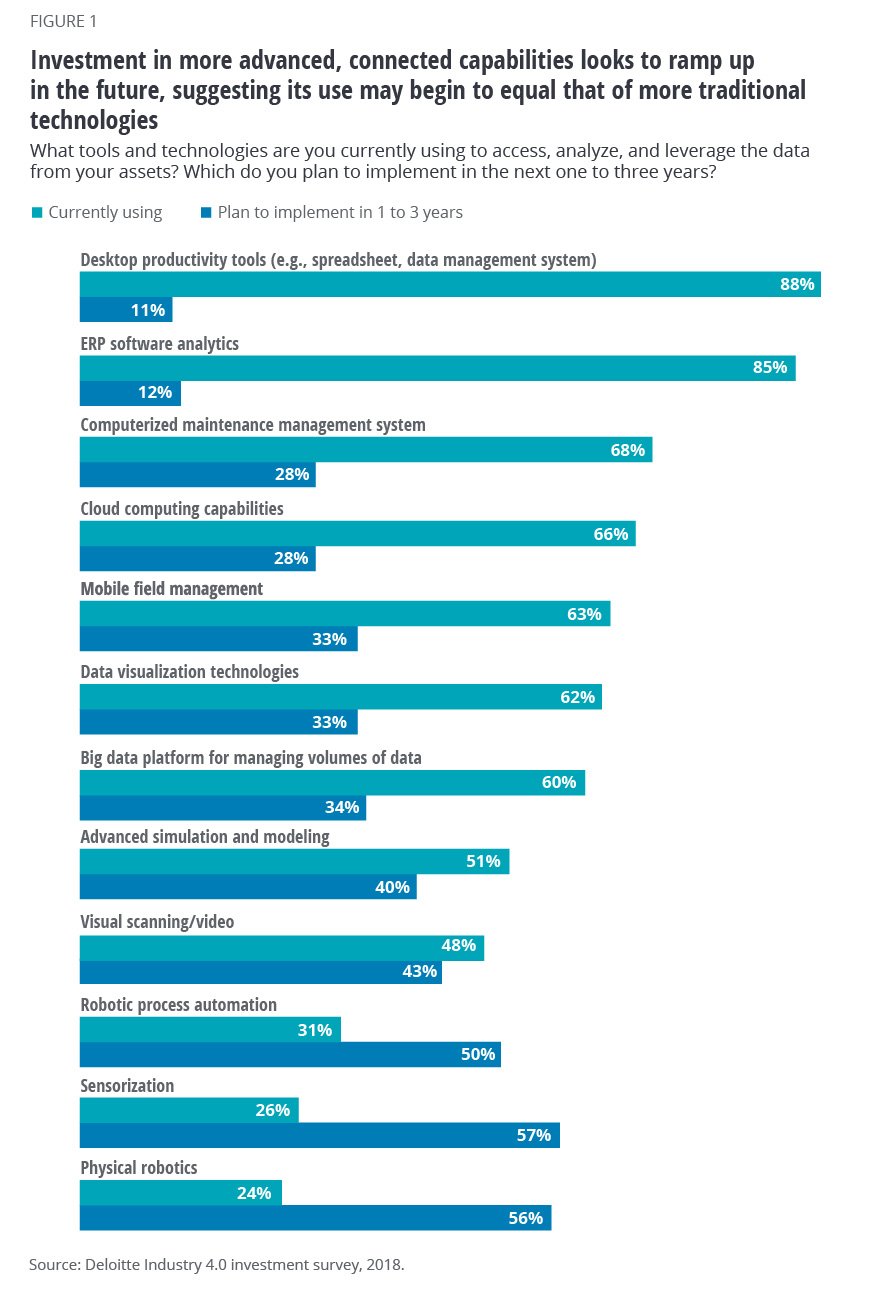

When it comes to how organizations are using technologies, most of their focus tends to rest on more “traditional” technologies, which reiterates the theme of building a strong foundation for digital transformation before moving into uncharted territory. At the same time, however, investment in more advanced, connected capabilities looks to ramp up in the future, suggesting the move toward innovation is on the horizon as part of a continued evolution, rather than a revolution (figure 1). Respondents appear to be preparing for an ever-more-connected future.

Respondents appear to be preparing for an ever-more-connected future.

Preparing for increased data loads. Computerized maintenance management systems (CMMS) and cloud computing capabilities are used by two-thirds of respondents but are likely to be used by nearly all within the next one to three years. The same is true for mobile field management, data visualization, and big data platforms for managing volumes of data. This suggests a move toward connectivity and ongoing preparation for handling increased loads of data.

Making the data user-friendly—and more usable. Advanced technologies remain an investment priority. As noted in The talent paradox, however, the high prioritization in hiring for user-experience and user-interface positions suggests a shift of focus toward technology usability as well. Thus, most organizations may not only be preparing to offer digitally transformative capabilities but also to ensure people will be able to use them.

High plans to invest in advanced technologies. While some newer technologies remain relatively low on the list—advanced simulation and modeling, visual scanning, RPA, sensors, and physical robotics—plans to invest in them are high, suggesting that a goal of digital transformation may be waiting in the future.

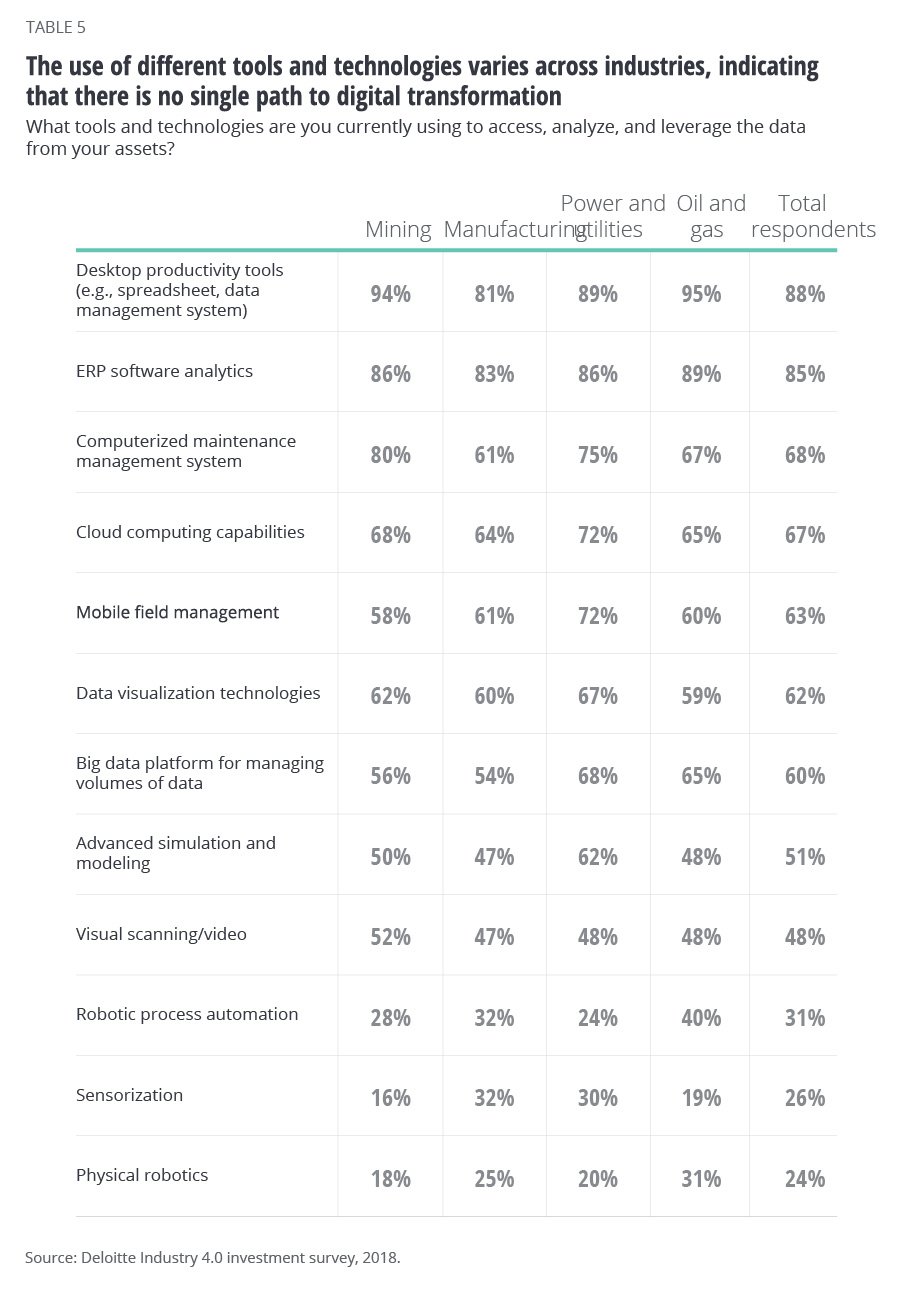

Industry-level differences in adoption. Examining the data by industry revealed some noteworthy differences. Manufacturing respondents, for example, reported lower current use of many technologies than their counterparts in other industries: Eighty-one percent report using desktop productivity tools, compared with more than 94 percent of both mining and oil and gas respondents, while 61 percent report using CMMS, compared with more than 75 percent of mining and power and utilities respondents. Manufacturers, however, report significantly higher use of sensors. Power and utilities respondents reported higher current use of big data platforms (68 percent), advanced simulation and modeling (62 percent), cloud computing (72 percent), and mobile field management (72 percent). Use of these technologies is perhaps reflective of each industry’s various complexities, whether the distributed nature of manufacturing or the remote monitoring needs of mining and oil and gas. In this way, a single path to digitally-transformative innovation does not exist; organizations can adopt the technologies that best suit the complex needs of their industry (table 5).

Conquering the innovation paradox

As organizations seek to adopt digitally transformative technologies within their organizations, the potential for innovation has never been greater. Respondents note that their companies are driven by—and currently prioritize—efforts intended to improve current operations and processes and build a strong foundation for future developments. As they continue to digitally transform, however, organizations should recognize that using technology to drive innovation, rather than just improve current processes, offers strong prospects for growth.

As they continue to digitally transform, organizations should recognize that using technology to drive innovation, rather than just improve current processes, offers strong prospects for growth.

To make innovation a part of a digital transformation strategy, organizations can:

- Get comfortable with the unknown. While operations and processes are important, know that innovation-driven uses of digitally transformative technologies are equally likely to yield a strong ROI. Opportunities can exist in the innovations space. Organizations can focus not only on building out the strong foundation of technologies, but also include truly innovative new approaches and priorities.

- Recognize the (perhaps reflexive) tendency to invest in productivity and operations.This is not necessarily a bad thing, given the high satisfaction observed. While operations-driven digital transformation can yield success, sticking with the continued evolution of the tried-and-true can leave opportunities untapped.

- Think about how foundational investment could lead to opportunities for true innovation. A strong foundation of digital transformation for fundamental operational purposes can in turn help pinpoint key white space opportunities for innovation. Use the insight gained from these foundational investments to create a more informed, targeted path for innovation.

- Get moving—because others are planning to. Relatively lower maturity in more innovative areas, coupled with higher planned investments in tools to harness advanced technologies, suggests that many organizations are planning to invest in capabilities that they expect will help them move further along on the digital transformation maturity curve. Those that fail to invest risk being left behind.

- Build a road map to greater ROI. Consider not only the context of digital transformation and uses of Industry 4.0 technologies within your industry, but also the technology investments you have already made, to drive your organization toward a high-ROI future.

Leaders have many choices as they seek to grow their organizations. In considering the multitude of digital transformation options at their fingertips, innovation should hold a place at the top of the list.

[av_hr class=’short’ height=’50’ shadow=’no-shadow’ position=’center’ custom_border=’av-border-thin’ custom_width=’50px’ custom_border_color=” custom_margin_top=’30px’ custom_margin_bottom=’30px’ icon_select=’yes’ custom_icon_color=” icon=’ue808′ font=’entypo-fontello’ av_uid=’av-aohxg’ custom_class=” admin_preview_bg=”]

Authors

Andy Daecher leads Deloitte Digital’s Internet of Things practice. He is based in San Francisco, CA.

Brenna Sniderman is a senior manager at Deloitte Services LP’s Center for Integrated Research. She is based in Philadelphia, PA.

The authors would like to thank Bill Ribaudo of Deloitte & Touche LLP; Mimi Lee, Joanna Lambeas, and Kristen Tatro of Deloitte Touche Tohmatsu Limited; Kevin D’Souza and Erin Lynch of Deloitte Consulting LLP; Brooke Lyon of Deloitte Services LP; and Hemnabh Varia and Abha Kulkarni of Deloitte Services India Pvt. Ltd. They would also like to thank Prasad Pai, Brad Goverman, and Liz Burrows of GE Digital.

Cover image: Kevin Weier

Endnotes

-

- Punit Renjen, The Fourth Industrial Revolution is here—are you ready?, Deloitte Review 22, January 22, 2018. View in article

- John Ferraioli and Rick Burke, Drowning in data, but starving for insights: Starting the digital supply network journey with legacy systems, Deloitte Insights, April 11, 2018. View in article

- Donald Mitchell and Carol Coles, “The ultimate competitive advantage of continuing business model innovation,” Journal of Business Strategy 24, no. 5 (2011): pp. 15–21. View in article

- Rick Burke et al., The smart factory: Responsive, adaptive, connected manufacturing, Deloitte University Press, August 31, 2017. View in article